Guide to the Fillable 8949 Tax Form

Tax season can be daunting for many, but with the right resources, it doesn't have to be. One essential tool for capital gains and losses is the 8949 tax form. In this article, we will walk you through the process of obtaining the fillable PDF, provide a list of rules for completing the form, share tips on how to file it correctly, and highlight some common mistakes people may face.

How to Obtain the Fillable 8949 Tax Form

The IRS provides a fillable 8949 form in PDF to make your life easier. You can access this document by visiting the IRS website and searching for "Form 8949" in the search bar. The first result should be the most recent version of the template, which you can download and save to your computer for easy access.

Fill Out IRS Form 8949 Appropriately

To ensure a smooth filing process, follow these rules when filling out your federal 8949 form:

- Enter your name and social security number at the top of the sample.

- For each transaction, describe the property, including the date acquired, date sold, sales price, and cost basis.

- Check the appropriate box to indicate whether the gains or losses are short-term or long-term.

- Calculate the gain or loss for each transaction by subtracting the cost basis from the sales price.

- Sum up the total gains and losses, and transfer these amounts to Schedule D of your tax return.

How to File the 8949 Form Correctly

Once you have completed the IRS Form 8949, it's time to file. Follow these guidelines to ensure a successful submission:

- Double-check your template for accuracy and completeness, ensuring all necessary fields are filled out.

- Attach the completed 8949 form to your tax return and any other required documents.

- File your tax return electronically or by mail, depending on your preference and eligibility.

- Keep a copy of your filed 8949 form for your records, as the IRS may request it.

Common Mistakes People May Face

Avoid these common errors when working with the 8949 tax form to ensure a smooth filing process:

- Failing to report all transactions, including those that result in a gain or loss.

- Incorrectly classifying gains and losses as short-term or long-term.

- Miscalculating the cost basis of an asset, leading to an inaccurate gain or loss amount.

- Not transferring the total gains and losses to your tax return Schedule D.

Related Forms

-

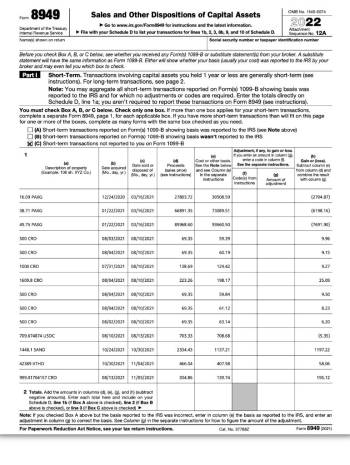

![image]() 8949 IRS tax form 8949 for 2022 is essential for taxpayers who have sold or exchanged capital assets, such as stocks, bonds, or real estate. This document, commonly known as the capital gains form 8949, is utilized to report the details of each transaction, including the acquisition cost, date of purchase, proceeds from the sale, and the resulting capital gain or loss. The information reported on this template is subsequently transferred to Schedule D of the taxpayer's federal income tax return, whic... Fill Now

8949 IRS tax form 8949 for 2022 is essential for taxpayers who have sold or exchanged capital assets, such as stocks, bonds, or real estate. This document, commonly known as the capital gains form 8949, is utilized to report the details of each transaction, including the acquisition cost, date of purchase, proceeds from the sale, and the resulting capital gain or loss. The information reported on this template is subsequently transferred to Schedule D of the taxpayer's federal income tax return, whic... Fill Now -

![image]() 2022 IRS Form 8949 Instructions Ah, the ever-daunting task of tax filing. But fear not, dear taxpayers, for we shall conquer the complexities of tax forms together, one step at a time. Today, we shall unravel the mysteries surrounding the IRS Form 8949, a crucial document that deals with reporting sales and dispositions of capital assets. So, without further ado, let's dive into understanding Form 8949, its purpose, and the essential details to consider when completing it. Unmasking the Purpose of Form 8949 The primary function of IRS Form 8949 is to report the sales and dispositions of capital assets, such as stocks, bonds, and real estate. Taxpayers need to complete this template if they have engaged in any of these activities during the tax year. Additionally, Form 8949 is used to reconcile amounts reported on the taxpayer's Schedule D and 1099-B template, which are used to report capital gains and losses, and proceeds from broker and barter exchange transactions, respectively. Key Details to Consider with Form 8949 To ensure the accurate completion of Form 8949, keep these essential details in mind: To compute the correct capital gains and losses, report transactions on Form 8949 by type, such as short-term and long-term. Choose the appropriate box (A, B, or C) depending on whether the basis of your capital asset was reported to the IRS, partially reported, or not reported at all. Accurately fill in the required columns for description, date acquired, date sold, proceeds, cost, and adjustments to gain or loss. Use the correct codes as provided in the Form 8949 instructions to report specific adjustments, such as wash sales, market discount, or non-deductible losses. If you have more transactions than can fit on one Form 8949, use additional forms as needed, and ensure to complete the summary section on each copy. Avoiding Common Mistakes on Form 8949 To minimize errors and ensure a smooth tax filing process, be aware of these common mistakes and tips to avoid them: Inaccurate Reporting of TransactionsDouble-check the transaction details and ensure they align with the information provided in your brokerage statements and other financial documents. Omitting TransactionsKeep a comprehensive record of all your transactions throughout the year to avoid accidental omissions when completing your sample. Miscalculating AdjustmentsCarefully follow the Form 8949 instructions when calculating adjustments, and consider seeking professional assistance if you are unsure about specific calculations. Misreporting BasisVerify the cost basis information provided by your broker and ensure it matches the information reported on Form 8949. Not Filing When RequiredEven if you do not owe taxes, you must still file Form 8949 if you have engaged in the sale or disposition of capital assets during the tax year. Fill Now

2022 IRS Form 8949 Instructions Ah, the ever-daunting task of tax filing. But fear not, dear taxpayers, for we shall conquer the complexities of tax forms together, one step at a time. Today, we shall unravel the mysteries surrounding the IRS Form 8949, a crucial document that deals with reporting sales and dispositions of capital assets. So, without further ado, let's dive into understanding Form 8949, its purpose, and the essential details to consider when completing it. Unmasking the Purpose of Form 8949 The primary function of IRS Form 8949 is to report the sales and dispositions of capital assets, such as stocks, bonds, and real estate. Taxpayers need to complete this template if they have engaged in any of these activities during the tax year. Additionally, Form 8949 is used to reconcile amounts reported on the taxpayer's Schedule D and 1099-B template, which are used to report capital gains and losses, and proceeds from broker and barter exchange transactions, respectively. Key Details to Consider with Form 8949 To ensure the accurate completion of Form 8949, keep these essential details in mind: To compute the correct capital gains and losses, report transactions on Form 8949 by type, such as short-term and long-term. Choose the appropriate box (A, B, or C) depending on whether the basis of your capital asset was reported to the IRS, partially reported, or not reported at all. Accurately fill in the required columns for description, date acquired, date sold, proceeds, cost, and adjustments to gain or loss. Use the correct codes as provided in the Form 8949 instructions to report specific adjustments, such as wash sales, market discount, or non-deductible losses. If you have more transactions than can fit on one Form 8949, use additional forms as needed, and ensure to complete the summary section on each copy. Avoiding Common Mistakes on Form 8949 To minimize errors and ensure a smooth tax filing process, be aware of these common mistakes and tips to avoid them: Inaccurate Reporting of TransactionsDouble-check the transaction details and ensure they align with the information provided in your brokerage statements and other financial documents. Omitting TransactionsKeep a comprehensive record of all your transactions throughout the year to avoid accidental omissions when completing your sample. Miscalculating AdjustmentsCarefully follow the Form 8949 instructions when calculating adjustments, and consider seeking professional assistance if you are unsure about specific calculations. Misreporting BasisVerify the cost basis information provided by your broker and ensure it matches the information reported on Form 8949. Not Filing When RequiredEven if you do not owe taxes, you must still file Form 8949 if you have engaged in the sale or disposition of capital assets during the tax year. Fill Now -

![image]() IRS Form 8949 Printable Filing taxes can be daunting, but grabbing the printable 8949 tax form is just a click away. Head to the IRS website and search for "Form 8949" in the search bar. You'll find the PDF version available for download. Once you have the file, you can either print it out or fill it in digitally using a PDF reader. Key Rules to Follow Filling out Form 8949 can be a breeze if you follow these crucial rules: Form 8949 deals with sales and other dispositions of capital assets. Understand whether your transaction is short-term or long-term before proceeding. Mistakes can cause unnecessary delays and potential penalties. Ensure all information is accurate and complete. The form requires specific codes for various adjustments and transactions. Make sure to use the right code for each entry. If you have more than one type of transaction, you may need to fill out multiple forms. Organize your transactions based on their categories and complete separate forms for each. In the case of an audit, having records of your transactions is essential. Document any sale, exchange, or disposition of a capital asset. Filing the 8949 Tax Form Like a Pro To submit the document correctly, follow these steps: Fill out the top portion of the form with your name and Social Security number. Choose the appropriate box for your transaction type (short-term or long-term). Input the necessary information for each transaction, including description, date acquired, date sold, sales price, and cost basis. Input any necessary codes and adjustments. Calculate your net gain or loss for each transaction. Complete Form 8949 for each transaction type, if applicable. Transfer the total gains and losses from each Form 8949 to Schedule D (Form 1040 or 1040-SR). Submit the completed Form 8949 and Schedule D and your income tax return. Form 8949 Due Date The due date for filing Form 8949 is the same as your income tax return deadline. For most taxpayers, this is April 15th. However, if you have a fiscal year rather than a calendar year, your due date will be the 15th day of the fourth month following the end of your fiscal year. In conclusion, filing the 8949 tax form doesn't have to be a headache. This guide provides a roadmap to help you easily navigate the process of obtaining, filling out, and submitting the copy. With these tips in hand, you'll be a tax-filing pro in no time. Fill Now

IRS Form 8949 Printable Filing taxes can be daunting, but grabbing the printable 8949 tax form is just a click away. Head to the IRS website and search for "Form 8949" in the search bar. You'll find the PDF version available for download. Once you have the file, you can either print it out or fill it in digitally using a PDF reader. Key Rules to Follow Filling out Form 8949 can be a breeze if you follow these crucial rules: Form 8949 deals with sales and other dispositions of capital assets. Understand whether your transaction is short-term or long-term before proceeding. Mistakes can cause unnecessary delays and potential penalties. Ensure all information is accurate and complete. The form requires specific codes for various adjustments and transactions. Make sure to use the right code for each entry. If you have more than one type of transaction, you may need to fill out multiple forms. Organize your transactions based on their categories and complete separate forms for each. In the case of an audit, having records of your transactions is essential. Document any sale, exchange, or disposition of a capital asset. Filing the 8949 Tax Form Like a Pro To submit the document correctly, follow these steps: Fill out the top portion of the form with your name and Social Security number. Choose the appropriate box for your transaction type (short-term or long-term). Input the necessary information for each transaction, including description, date acquired, date sold, sales price, and cost basis. Input any necessary codes and adjustments. Calculate your net gain or loss for each transaction. Complete Form 8949 for each transaction type, if applicable. Transfer the total gains and losses from each Form 8949 to Schedule D (Form 1040 or 1040-SR). Submit the completed Form 8949 and Schedule D and your income tax return. Form 8949 Due Date The due date for filing Form 8949 is the same as your income tax return deadline. For most taxpayers, this is April 15th. However, if you have a fiscal year rather than a calendar year, your due date will be the 15th day of the fourth month following the end of your fiscal year. In conclusion, filing the 8949 tax form doesn't have to be a headache. This guide provides a roadmap to help you easily navigate the process of obtaining, filling out, and submitting the copy. With these tips in hand, you'll be a tax-filing pro in no time. Fill Now -

![image]() 8949 Federal Tax Form Hello, dear readers! Today, we'll be diving into the world of taxes, specifically IRS Form 8949. Before you yawn and click away, let me assure you that understanding this form can save you time, money, and potential headaches during tax season! So, let's embark on a journey through Form 8949, its importance in 2023, exemptions, and changes in the template for 2022-2023 compared to previous years. Are you ready? Let's go! The Creating of Form 8949 The history of IRS Form 8949 dates back to 2011 when the IRS introduced it to report capital gains and losses from various investments. This form ensures taxpayers accurately report their investment income and pay the appropriate taxes. Fast forward to 2023, and Form 8949 has become essential to tax filing. People must use this form due to the following reasons: It allows taxpayers to report their capital gains and losses from the sale of stocks, bonds, mutual funds, and other investments. The IRS uses the information provided in the template to ensure taxpayers accurately report their investment income and pay the correct taxes. Form 8949 also helps taxpayers calculate their adjusted basis for investments, which is crucial for determining their taxable gains or losses. Terms & Rules of 8949 Tax Form Using While most taxpayers with investment income are required to use Form 8949, there are some exemptions. Here's a handy bullet list of situations in which you might be exempt from using capital gains document: Taxpayers who have only received Form 1099-B with the correct cost basis and capital gains or losses already reported. Taxpayers who have only non-covered securities and have reported the correct cost basis, capital gains, or losses directly on Schedule D. The 8949 Form Template & Its Updates Now, let's talk about the changes in the template for Form 8949 in 2022-2023 compared to previous years. While the basic structure of the form remains the same, there are a few noteworthy updates: The IRS has made some minor adjustments to the form's layout, making it more user-friendly and easier to navigate. New instructions for reporting virtual currency transactions reflect the growing importance of digital assets in the financial world. The IRS now requires taxpayers to report transactions involving certain specified securities, such as those acquired through employee stock purchase plans, in a separate form section for better tracking and compliance. Fill Now

8949 Federal Tax Form Hello, dear readers! Today, we'll be diving into the world of taxes, specifically IRS Form 8949. Before you yawn and click away, let me assure you that understanding this form can save you time, money, and potential headaches during tax season! So, let's embark on a journey through Form 8949, its importance in 2023, exemptions, and changes in the template for 2022-2023 compared to previous years. Are you ready? Let's go! The Creating of Form 8949 The history of IRS Form 8949 dates back to 2011 when the IRS introduced it to report capital gains and losses from various investments. This form ensures taxpayers accurately report their investment income and pay the appropriate taxes. Fast forward to 2023, and Form 8949 has become essential to tax filing. People must use this form due to the following reasons: It allows taxpayers to report their capital gains and losses from the sale of stocks, bonds, mutual funds, and other investments. The IRS uses the information provided in the template to ensure taxpayers accurately report their investment income and pay the correct taxes. Form 8949 also helps taxpayers calculate their adjusted basis for investments, which is crucial for determining their taxable gains or losses. Terms & Rules of 8949 Tax Form Using While most taxpayers with investment income are required to use Form 8949, there are some exemptions. Here's a handy bullet list of situations in which you might be exempt from using capital gains document: Taxpayers who have only received Form 1099-B with the correct cost basis and capital gains or losses already reported. Taxpayers who have only non-covered securities and have reported the correct cost basis, capital gains, or losses directly on Schedule D. The 8949 Form Template & Its Updates Now, let's talk about the changes in the template for Form 8949 in 2022-2023 compared to previous years. While the basic structure of the form remains the same, there are a few noteworthy updates: The IRS has made some minor adjustments to the form's layout, making it more user-friendly and easier to navigate. New instructions for reporting virtual currency transactions reflect the growing importance of digital assets in the financial world. The IRS now requires taxpayers to report transactions involving certain specified securities, such as those acquired through employee stock purchase plans, in a separate form section for better tracking and compliance. Fill Now -

![image]() Tax Form 8949 Example Imagine a world where tax season is as enjoyable as a walk in the park or a piece of cake. Quite a fantasy, right? For most people, tax season is more like navigating a labyrinth, and one of its most puzzling components is the infamous tax form 8949. This form, required by the IRS to report the sale or exchange of capital assets, can be confusing and frustrating for taxpayers. But fear not, dear reader! In this article, we'll delve into some unusual cases where form 8949 comes into play, provide solutions for each case, and guide you through rectifying any mistakes made when filing the form. 8949 Tax Form: Unusual Cases & Solutions Cryptocurrency ConundrumCryptocurrencies, like Bitcoin and Ethereum, have been making headlines and turning heads in the financial world. But did you know that they're also subject to taxes? That's right: if you've bought, sold, or exchanged cryptocurrencies, you'll need to report these transactions on form 8949. To ensure accurate reporting, maintain detailed records of purchase and sale dates, as well as the fair market value of the cryptocurrency at the time of each transaction. Solution: Stay organized and keep thorough records of all your cryptocurrency transactions. Consider using specialized software or seek the guidance of a professional tax advisor to help you report these transactions accurately on form 8949. Artful DodgingFor art collectors, selling a prized piece can be both emotionally and financially taxing. And yes, you guessed it: the sale of art is also subject to capital gains tax, which means you'll need to report it on form 8949. To determine the correct gain or loss, you'll need to know the cost basis (i.e., the original purchase price) of the artwork and the sale price. Solution: Keep meticulous records of your art transactions, including purchase and sale prices, and seek the advice of a tax professional to ensure you're reporting gains and losses correctly on form 8949. Inherited Stock WoesInheriting stocks can be a financial boon, but it also comes with tax implications. When you sell inherited stocks, you'll need to report the transaction on form 8949. The tricky part here is determining the cost basis of the stocks, which is typically the fair market value on the date of the decedent's death. Solution: Consult the estate's executor or a tax professional to obtain the necessary information for determining the cost basis of inherited stocks. Armed with this information, you can accurately report the sale on form 8949. What to Do When Mistakes Happen We're all human, and mistakes can happen when filing tax forms. If you've discovered an error on your form 8949, don't panic! First, review the specific mistake and gather any necessary documentation to support the correction. Next, file an amended tax return using form 1040-X, and attach a corrected form 8949. In conclusion, while form 8949 might seem daunting, understanding its purpose and knowing how to accurately report various types of transactions can help you navigate the tax labyrinth with confidence. With the right tools and advice, tax season might just become a walk in the park after all. Fill Now

Tax Form 8949 Example Imagine a world where tax season is as enjoyable as a walk in the park or a piece of cake. Quite a fantasy, right? For most people, tax season is more like navigating a labyrinth, and one of its most puzzling components is the infamous tax form 8949. This form, required by the IRS to report the sale or exchange of capital assets, can be confusing and frustrating for taxpayers. But fear not, dear reader! In this article, we'll delve into some unusual cases where form 8949 comes into play, provide solutions for each case, and guide you through rectifying any mistakes made when filing the form. 8949 Tax Form: Unusual Cases & Solutions Cryptocurrency ConundrumCryptocurrencies, like Bitcoin and Ethereum, have been making headlines and turning heads in the financial world. But did you know that they're also subject to taxes? That's right: if you've bought, sold, or exchanged cryptocurrencies, you'll need to report these transactions on form 8949. To ensure accurate reporting, maintain detailed records of purchase and sale dates, as well as the fair market value of the cryptocurrency at the time of each transaction. Solution: Stay organized and keep thorough records of all your cryptocurrency transactions. Consider using specialized software or seek the guidance of a professional tax advisor to help you report these transactions accurately on form 8949. Artful DodgingFor art collectors, selling a prized piece can be both emotionally and financially taxing. And yes, you guessed it: the sale of art is also subject to capital gains tax, which means you'll need to report it on form 8949. To determine the correct gain or loss, you'll need to know the cost basis (i.e., the original purchase price) of the artwork and the sale price. Solution: Keep meticulous records of your art transactions, including purchase and sale prices, and seek the advice of a tax professional to ensure you're reporting gains and losses correctly on form 8949. Inherited Stock WoesInheriting stocks can be a financial boon, but it also comes with tax implications. When you sell inherited stocks, you'll need to report the transaction on form 8949. The tricky part here is determining the cost basis of the stocks, which is typically the fair market value on the date of the decedent's death. Solution: Consult the estate's executor or a tax professional to obtain the necessary information for determining the cost basis of inherited stocks. Armed with this information, you can accurately report the sale on form 8949. What to Do When Mistakes Happen We're all human, and mistakes can happen when filing tax forms. If you've discovered an error on your form 8949, don't panic! First, review the specific mistake and gather any necessary documentation to support the correction. Next, file an amended tax return using form 1040-X, and attach a corrected form 8949. In conclusion, while form 8949 might seem daunting, understanding its purpose and knowing how to accurately report various types of transactions can help you navigate the tax labyrinth with confidence. With the right tools and advice, tax season might just become a walk in the park after all. Fill Now