IRS Form 8949: A Comprehensive Guide for Accurate Reporting

IRS tax form 8949 for 2022 is essential for taxpayers who have sold or exchanged capital assets, such as stocks, bonds, or real estate. This document, commonly known as the capital gains form 8949, is utilized to report the details of each transaction, including the acquisition cost, date of purchase, proceeds from the sale, and the resulting capital gain or loss. The information reported on this template is subsequently transferred to Schedule D of the taxpayer's federal income tax return, which is used to calculate the overall capital gains fiscal responsibility.

Navigating the complexities of tax forms can be arduous for many individuals, and this is where the website 8949taxform.com comes into play. This valuable online resource offers a Form 8949 fillable PDF, allowing users to input their transactional data directly onto the template. The website also provides a Form 8949 sample, which serves as a definitive guide to help taxpayers understand how to fill out the printable copy correctly. Utilizing this website's wealth of information and resources can significantly assist taxpayers in successfully navigating the process of reporting their capital gains transactions.

Using IRS Form 8949: Detailed Example

- Let's consider John Doe, a fictional individual who must fill out the 8949 form. John is an investor who trades stocks in the stock market throughout the year. He sold several company shares in the past year, resulting in profits and losses. John's investment activities make him subject to capital gains tax, levied on the net gain from the sale of capital assets. To correctly report these gains and losses, John must fill out the printable 8949 form, providing information about each transaction, such as acquisition and sale dates and costs and proceeds.

- To ensure compliance with the tax code, John must meticulously record his transactions and complete the 8949 form before submitting it to the IRS. By doing so, he will provide the necessary information for accurately calculating his tax liability, essential for maintaining a healthy financial standing and avoiding potential penalties. Individuals like John, who sell or exchange capital assets, must fill out the printable IRS tax form 8949 to accurately report their gains and losses, ensuring proper adherence to U.S. laws and regulations.

Tax Form 8949 Due Date

The deadline for filing federal tax form 8949 for 2022 coincides with submitting your individual income return declaration, typically April 15. This specific date is chosen as it marks the end of the fiscal year, allowing taxpayers ample time to gather and organize their financial records.

You may be eligible for an extension to file your IRS Form 8949 PDF in certain circumstances. You must submit a completed example by the original due date to request this. This grants an additional six months, extending the deadline to October 15. It is essential to note that an extension to file does not provide extra time to pay any taxes owed, so timely payment is still required to avoid penalties.

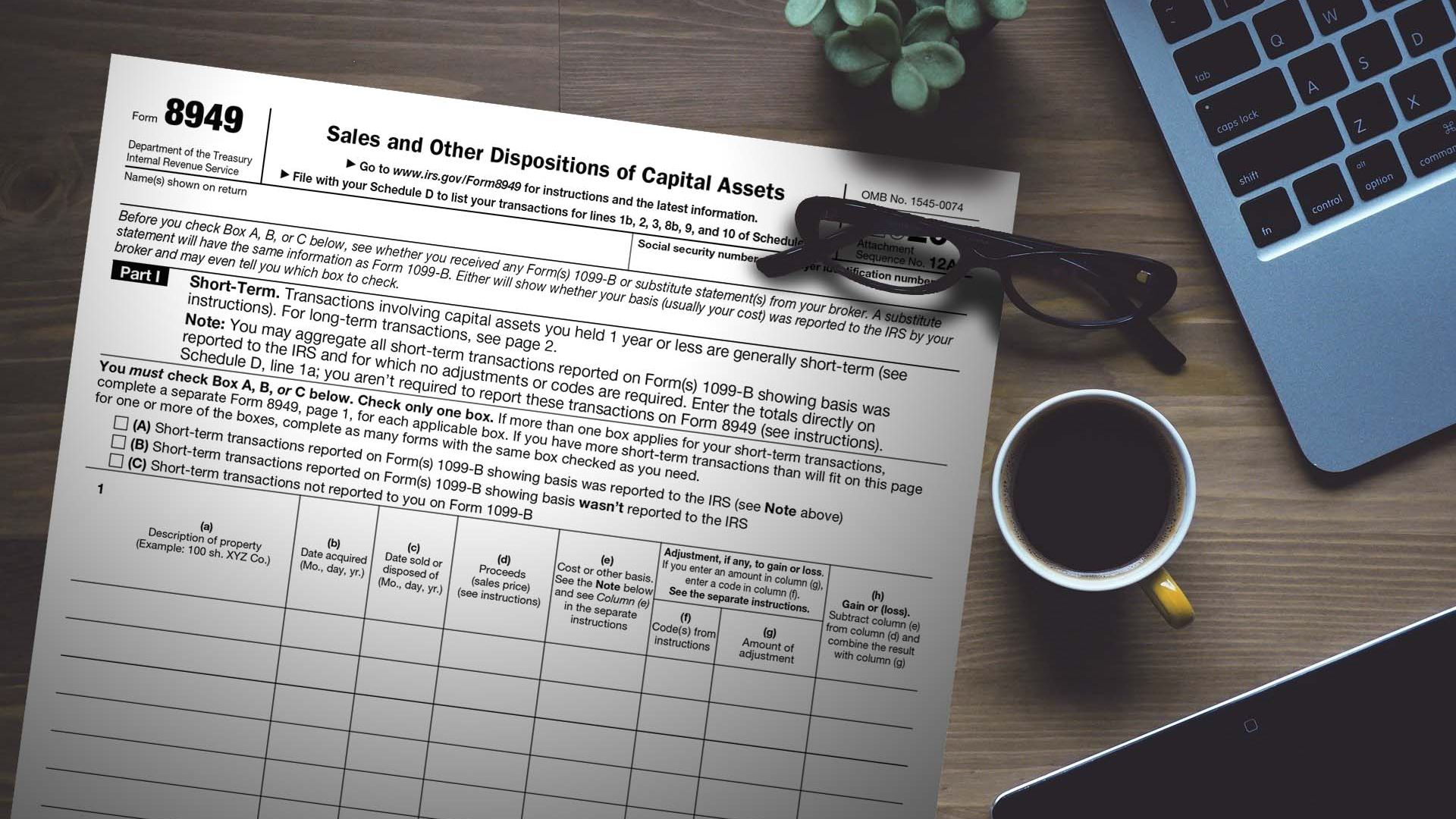

Blank 8949 Tax Form: Fill It Out Correctly

- Fill in the full name, Social Security Number (SSN), and address

- Indicate the relevant tax year for reported transactions

- Separate short-term and long-term transactions

- Specify the type of asset (e.g., stocks, bonds, real estate)

- Include exact dates for both transactions

- Report the total amount received from the sale

- Document the original cost or adjusted basis of the asset

- Apply any relevant codes for specific adjustments (e.g., wash sales)

- Calculate the net gain or loss for each transaction

IRS 8949-Related Forms

- Form 1099-B is a crucial document for taxpayers involved in stock transactions. This example, issued by brokers or barter exchanges, provides comprehensive information on the sale of stocks, bonds, commodities, or other securities within a given tax year. The details captured in Form 1099-B include the date of acquisition, proceeds from the sale, whether the gain or loss was short-term or long-term, and the cost basis if available.

- Schedule D (Form 1040) plays a significant role in the reporting process for capital gains and losses. This document serves as a summary of the information outlined in Form 8949 and is used to consolidate the results of all investment transactions. By completing Schedule D, taxpayers can determine the net capital gain or loss for the tax year, ultimately impacting their adjusted gross income reported on Form 1040.

Filing Tax Form 8949: Possible Penalties

Filing taxes can be complex, particularly when dealing with capital gains and losses. The IRS Form 8949 is a crucial document that taxpayers must fill out accurately to report these financial transactions. There are potential penalties for improperly filing Form 8949 or providing false information.

- Failure to file IRS Form 8949 fillable promptly can lead to late filing penalties. The IRS may charge interest on the unpaid tax for each month or part of the month the copy is late.

- Providing a tax form 8949 example with incorrect or falsified data may result in severe fines imposed by the Internal Revenue Service (IRS). These penalties can range depending on the extent of the inaccuracies and the intent behind them.

- Deliberately omitting or underreporting income results in a civil fraud penalty. This penalty is equal to 75% of the underreported tax due. Taxpayers who submit false information on their 8949 forms may also face criminal charges. This can result in imprisonment and substantial monetary fines.

- If the IRS suspects a taxpayer has engaged in tax evasion by providing misleading information on Form 8949, they may be subjected to an audit. The result of an audit can lead to additional tax liabilities, penalties, and interest.

Instructions to File the 8949 Tax Form in 2023

- What is the purpose of U.S. Form 8949, and who needs to file it?The document reports the sale and exchange of capital assets, including stocks, bonds, and other investments. If you’ve sold or exchanged fixed investments during the previous year, you must complete this form and attach it to your Schedule D on your tax return. This form is necessary for taxpayers to calculate their gains or losses from capital asset transactions and report them to the Internal Revenue Service (IRS).

- Where can I find a printable version of IRS Form 8949 and its instructions?The relevant template and detailed guide are on the official IRS website. Simply search for "Form 8949" in the search bar, and you will be directed to the appropriate page. From there, you can download the template and instructions as PDF files, which can be printed for your convenience.

- Can I complete an online form 8949 instead of using the paper version?You can complete and file fillable Form 8949 online through various tax software programs or an authorized e-file provider. These options allow you to fill out the PDF electronically and submit it directly to the IRS. You must still attach the completed Form 8949 to your Schedule D when filing your tax return, even if you submit it electronically.

- What are the essential IRS Form 8949 instructions I should follow when completing the template?If you have sold or exchanged capital assets during the tax year, you may need to file printable Form 8949 and Schedule D (1040). You must provide information about the property you sold or exchanged, such as the date acquired, date sold, sales price, and cost or other bases.

- Where can I find additional resources and instructions for Form 8949?For further information and guidance on completing the template, read instructions from the IRS website or consult a tax professional. Additionally, there are a variety of publications and resources on other websites to help taxpayers understand the taxation requirements and procedures.

More Form 8949 Samples & Examples

- 2022 IRS Form 8949 Instructions Ah, the ever-daunting task of tax filing. But fear not, dear taxpayers, for we shall conquer the complexities of tax forms together, one step at a time. Today, we shall unravel the mysteries surrounding the IRS Form 8949, a crucial document that deals with reporting sales and dispositions of capital... Fill Now

- IRS Form 8949 Printable Filing taxes can be daunting, but grabbing the printable 8949 tax form is just a click away. Head to the IRS website and search for "Form 8949" in the search bar. You'll find the PDF version available for download. Once you have the file, you can either print it out or fill it in digitally using a P... Fill Now

- Fillable IRS Form 8949 Tax season can be daunting for many, but with the right resources, it doesn't have to be. One essential tool for capital gains and losses is the 8949 tax form. In this article, we will walk you through the process of obtaining the fillable PDF, provide a list of rules for completing the form, share... Fill Now

- 8949 Federal Tax Form Hello, dear readers! Today, we'll be diving into the world of taxes, specifically IRS Form 8949. Before you yawn and click away, let me assure you that understanding this form can save you time, money, and potential headaches during tax season! So, let's embark on a journey through Form 8949, its im... Fill Now